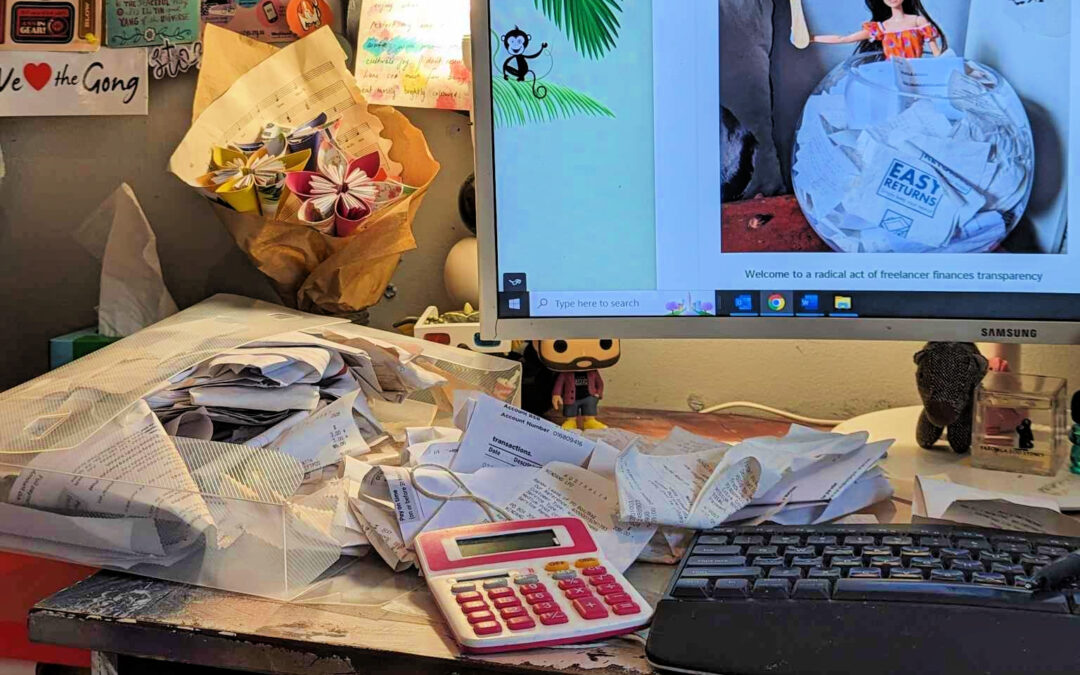

Like most freelancers, I saved up accounting activities into large indigestible chunks. I hear it a lot around BAS time. We’re like reluctant heroes disappearing beneath the waves of accounting hell to slay a deep-sea monster.

Receipts? Check.

Receipts? Check.

Invoices that are overdue? Double check.

Kiss the dog, pat the partner.

Pack three days’ worth of emotional support Tim Tams, and hopefully, I’ll emerge from the office soon.

To say that was about as useful as a tissue paper umbrella in an Illawarra mega storm is very much an understatement.

My super clever ideas included:

- Thumb tacking store receipts to the corkboard above my desk

- Saving payment confirmation emails in one folder in my inbox

- Denying client work for days to trawl through everything

- Auto-deducting plugins, software, and course items

- Avoiding my bank account to avoid stress

What that meant in reality was I had:

- Faded invoices I couldn’t read

- Deductions I missed

- An overflowing inbox

- Sloppy accounting

- A passionate hatred of BAS

- Paid for things I no longer used

- Lots of software laziness tax

- Late paying clients

- Little to no idea about the money I was earning

The more I stayed away from accounting, the more I hated it. And the more I hated it, the more I stayed away. The only thing that prodded me to action was the yearly, then quarterly, deadlines.

And I’ve discovered firsthand it’s a stressful way to live and you do more accounting that way.

Here’s how I avoid the accounting scramble by not letting my accounting get on top of me or pushing it away

Committing to daily routine

James Clear has a great perspective on goals, and that is:

Winners might have goals, but so do the losers. The difference is winners have a system.

It’d be nice to be ready for BAS and not stress about it, but hoarding accounting responsibilities up makes them more punishing, not less.

Pushing a button to find the accounts are ready is a great way to market accounting software. But those bloody expenses won’t enter themselves.

Nor will your bank account put your lackadaisical client in a headlock and demand, “feed me!” when the invoices are overdue.

Well, at least until the AI matures, anyway.

Channelling James Clear, now I have a system where I:

- Log into Rounded on workdays as my first TO DO

- Start the timer to log the accounting activity

- Refresh the bank feed

- Mark off the paid invoices

- Add the deductions for the business via the bank account (and the corkboard)

- Check all account levels to make sure any expected bills won’t default

- Stop the timer

Holding my accounting back in an enormous pile, I’d find myself overwhelmed by the sheer weight of work. Now, it feels completely benign.

TIME TAKEN: It takes approximately 2 to 5 minutes a day.

Having a life admin day

I had the absolute pleasure of being a member of LA counsellor and creative coach, Beth Pickens, Homework Club. One of the most wonderful lessons I gained from Beth is the importance of a life admin day for self-employed creatives and freelancers.

These life admin days make my daily and longer financial routines avoid the scramble. And help me be more in control of the financial side of my business.

I hold mine on the first day of the month and it includes:

- Checking expenses due that month, i.e. looking at my May 2023 deductions in Rounded and making sure I want them to renew in May 2024

- Sending any custom emails needed to late paying clients

- Setting up my month in the Rounded time tracker

- Making a note of my calendar appointments with BAS, my accountant, etc. and what I need to prepare

- The money shuffle – I leave a float and short suit my bank accounts of the rest and dump everything in the business saver as BAS, GST, ITR monies plus my buffer against lean client times, etc

I also use it as an opportunity to:

- Assessing the four parts of my business – direct client work, Freelance Jungle work, coaching work, other opportunities (grants, prizes etc) – you can find out more about that with this blog

- Clear out any lingering red flags in my email inbox

- Follow up any extraneous requests

- Restock my social media to match the work I want to attract re: availability or service

- Identify the grants, prizes, and fellowships I want to enter

This helps me feel strategic about my choices while making sure I know:

- How much work I have

- Where the money is coming from

- Where the money is going

- How I can make more

- What’s on the cards for non-revenue generation activities

TIME TAKEN: This takes half a day a month. If I finish early, I take the time off as a reward. Win, win!

Choosing the automation wisely

Automation is a blessing and a curse in freelance finances. Relying on it too heavily in the past has seen me pay for software and tools I didn’t need. Not using it at all has delayed me asking for overdue money with clients and get buried in business admin.

It is a trial-and-error process, but I use automation to:

- Send out reminders on the 8th day to late paying clients

- Schedule recurring invoices like retainers and repeating quarterly agreements

- Renew anything that won’t be changing. E.g. my Divi subscription

TIME TAKEN: The time saved varies, but I can safely estimate that dealing with late clients, getting new ones on board, and preventing disasters takes about half a day every few months.

Beyond project management

Having a regular daily, monthly, and verified automated process has made me far more efficient. It also makes accounting a fairly neutral activity these days. And that’s amazing for me because it’s been an enormous source of pain and anxiety previously.

But more than that, the repeatable processes have helped me:

- Cut down the legwork. Doing admin and accounting regularly means I don’t have to dig, search or worry where something has gone. That saves me hours and hours of stress and workload

- Spot mistakes early and often. I found a plugin that I used on a website I haven’t owned in years was still auto-deducting. We paid for gas with no gas appliances because we transferred the connection when we moved house. It sucks spending a couple of grand on nothing because you’re slack checking auto-deductions – and it won’t be happening to me again!

- Let go of negative thoughts about money and valuing myself. I view money as a tool. That depersonalises and diffuses a lot of the emotional baggage I used to associate with it. And makes saying no to free work or ideas that don’t change the game that much easier

- Grow confidence with the financial side of the business. Even when I committed to looking at this with Rounded, I was worried because people would judge me based on my mistakes. The opposite has been true. Talking about money, accounting and finances isn’t scary. In fact, it’s empowering

I have spoken about the mistakes I have made when dealing with the financial side of my business. I’ve even committed to radical transparency around my finances to learn better habits. And I’ve gamified my way through it with a zeal I never thought previously possible.

The biggest lesson I’ve learned is that keeping a closer eye on the financial side of my business would’ve helped me avoid all my problems. I’m definitely feeling more professional, empowered, and less stressed!

Want to make accounting a friend instead of a foe? Sign up for your four-week trial of Rounded now.

Please note: This blog post is sponsored by Rounded as part of an ongoing exploration of Rebekah Lambert’s approach to her freelance business. The idea is to open up Rebekah’s finances so she can improve – and help you, too. Any financial information provided serves as a general guide and should not be considered professional advice. For personalised guidance, consult with your accountant or financial advisor.