2024 is my year of freelance experiments. I’m writing, creating, and studying more. I’m digging deep into learning (and learning by doing) with Patreon, studying counselling, and getting right into industry and personal challenges.

And one of the biggest freelance challenges on my 2024 bingo card is (my sincere lack of) financial literacy.

In a lightning flash of genius (or absurdity), I thought, why not solve my finance-related problems and take you, the Freelance Jungle audience, along for the ride with me?

In a lightning flash of genius (or absurdity), I thought, why not solve my finance-related problems and take you, the Freelance Jungle audience, along for the ride with me?

So, I wrote out six different ways I sucked at my freelance finances and what I thought I should do about it. Not content with one audience, I thought, why not add another one?

I trotted off to Rounded with my list of financial fails, and that lovely feeling you get when something is still in theory.

They thought it was a great idea, so they are backing me as I do it via blogs and social media.

Fast forward and now I’m committed to disclosing my monetary soul <gulp> as a month-by-month live action experiment which I hope will have a positive outcome for you and me!

Why am I opening up about the financial side of my freelance business?

Experimental allure aside, I’m uniquely qualified to talk about how to make a mess of your freelance finances and live to tell the tale. Only my capacity for learning from mistakes has helped me stay in the game.

Since starting a full-time freelance career in 2010, I have:

- Undercharged

- Struggled with expenses

- Lived in absolute fear of doing my tax

- Accrued massive tax debts

- Neglected my super

- Overworked myself into non-existent profit

- Fawned on clients and invited scope creep

- Done my record keeping in shoeboxes and spreadsheets

- Had to redo invoices and beg clients for GST because I misunderstood the $75K cutover

- Cried into my Christmas Day two-minute noodles while stalking clients on Facebook as they holidayed in Hawaii

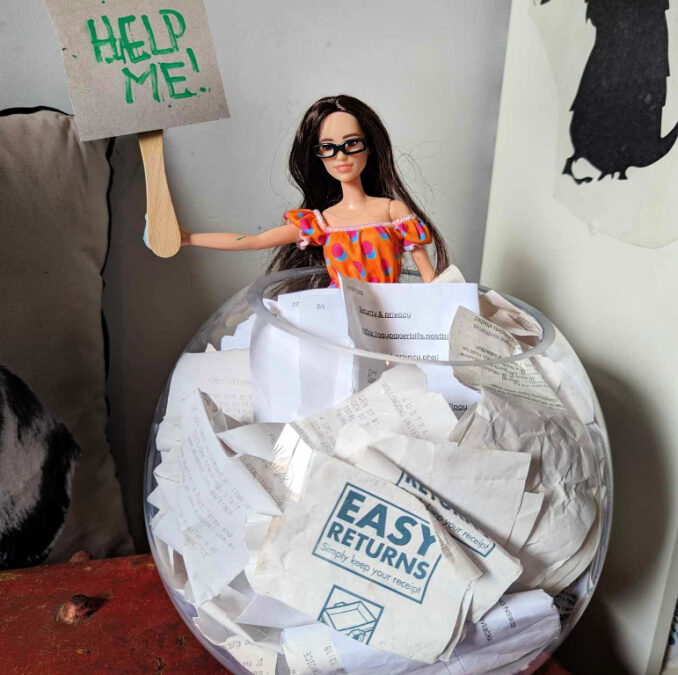

- Resorted to cardboard signs reading “WILL WRITE COPY FOR FOOD” for both business development and shaming clients into paying their invoices

It probably comes as no surprise that the reason I started the Freelance Jungle wasn’t some intentional business development move. I launched a survey in 2011 to find out just how much I sucked at freelancing by finding out if you were as clueless, anxious, and hungry as me.

The results both heartened and shocked me.

One hundred and sixty-six freelancers responded. They also sucked at:

- Chasing overdue money

- Managing cash flow

- Pushing back on low ball rates

- Pricing themselves

- Doing tax and BAS

- Keeping up with business admin

- Paying super (or understanding it)

- Asking clients for super

- Understanding GST

- Knowing what to expense

- Financial planning

- Turning a profit

- Securing home loans

- Making ends meet

And that’s how the Freelance Jungle began, trying to solve these problems.

I wanted to end the isolation to prevent us repeating each other’s mistakes and encourage learning from lived experiences. I invited the Sydney-based survey respondents to beer and pizza in Surry Hills. After a couple of months of that, I took it online to Meetup, GooglePlus, and eventually Facebook.

A bunch of freelancers swapping war stories at the pub turned into an Australia wide (and New Zealand inclusive) group with six thousand seven hundred people.

As the founder of the Freelance Jungle, ending isolation, reminding freelancers stress has a productivity cost, and raising the knowledge bar has been my focus for twelve years.

In that time, I’ve learned a thing or two.

I am good at debt collection, have matured in my pricing, and can save money like a coin-obsessed squirrel. My client management game is much stronger, and I enjoy helping you.

I’ve also met some great allies along the way:

- My accountant, Holly Shoebridge from Oceans Accounting and Advisory, is amazing. She’ll feature in this adventure from time to time and I’m sure you’ll like her as much as I do

- My accounting software, Rounded. The software, the customer service, and Olly have been really helpful to both me and the Freelance Jungle

But I always feel like I’m on the verge of the next math-related crisis. Probably because I avoid digging too deep and don’t really understand what I am looking at, figures and reporting-wise. I have decades of finance and money-related poor mindset and unhealthy habits to unpack.

Accounting still makes me nervous. BAS and BAS time trigger extreme anxiety in me. Last year’s Income Tax Return left me with a $5K debt, making me avoid my accounting for weeks. As I get older and want to work less (and hopefully retire before my 112th birthday), all of this is taking a much bigger toll on my mental health than when I started freelancing.

And I’m tired of living this way.

So, until the end of the financial year, I am opening the doors on my financial frailties with help from Rounded and Holly. This is a real time experiment of knocking down the walls around how I relate to money to increase my financial literacy.

Are you with me?

I was an ostrich with my head in the sand around finances for the first 18 months of freelancing. DO NOT RECOMMEND.

Thank gawd I signed up to Rounded early on (the first of many FJ recommendations I’ve followed) and got my taxes sorted out before Christmas.

The rest? Fuck.

Needless to say I’m so happy that this is happening

Yay! Glad to hear you got it together eventually. It took me YEARS! So, 18 months isn’t bad in the scheme of things.

Here’s hoping we can all learn by me doing.