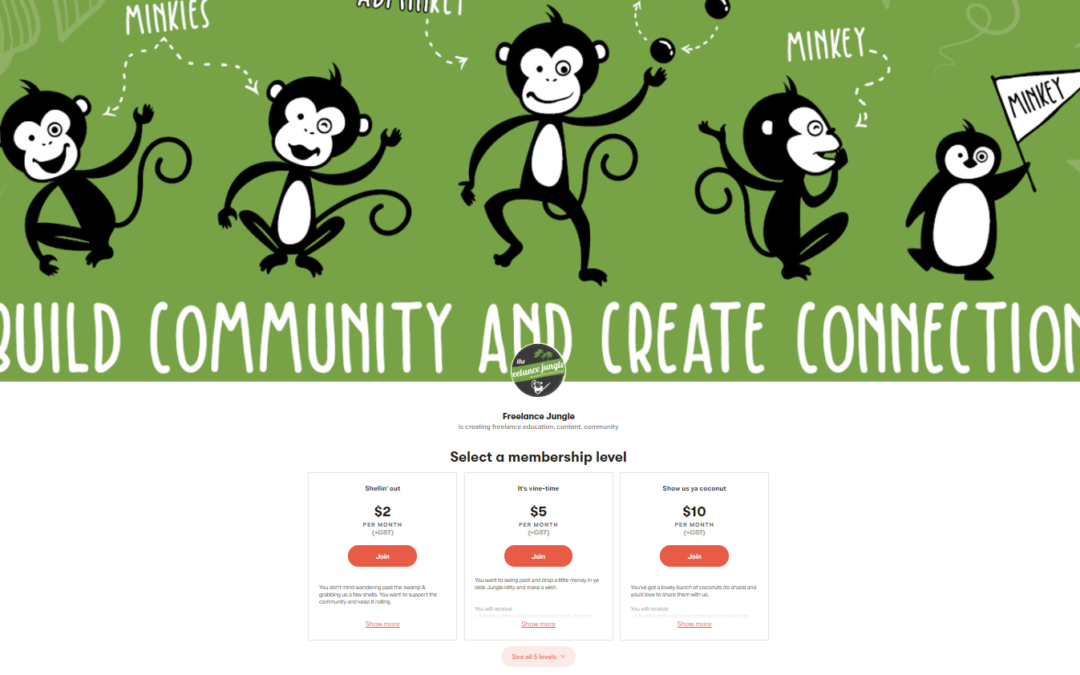

This is a rundown of the Freelance Jungle Patreon and GST situation. Patreon began charging GST on certain elements from July 1st 2020. This does impact your pledges.

Whether you are registered for GST has a bearing on how this influences you:

From 1 July 2020, the platform will be implementing 10% GST on relative sales made through Patreon platform – if the services provided are deemed to be required to incur GST (I would say that is quite likely as much of it is education and access like you’d find in a traditional membership style).

Patreon will be using AI to determine what type of services are being offered in the tiers, correlating them with Australian GST law to determine if GST is required to be applied and then wack 10% on the identified tiers. I have given my feedback to keep things like Jungle Jobs access, postcards and behind the scenes stuff free. However, they get the final decision. To cover your bum, I would suggest mentally calculating your tier to have the 10% extra applied and adjust accordingly.

If you are registered for GST

The GST will be 100% claimable in Pinkies activity statements, if this membership is treated as an allowable deduction for business purposes. This is influenced by your particular stock and trade as to what expenses you can claim for GST and tax purposes. For example, your accountant may see it as a professional membership, learning experience or something that is available to you under taxable costs. To determine if this is an eligible claim for you, and how it is to be treated, please speak with your accountant.

So as an example, Debbie Jones pays $10 monthly through Patreon. My understanding is that this will now become $11 and because Debbie is GST registered, she’ll be able to claim the full additional $1 back in her quarterly or annual activity statement. This is the same thing you do with other tax. It’s like we collect the GST on behalf of the government for whatever goods and service applies.

If you are NOT registered for GST

For the Pinkies who are not GST registered, they will treat the additional $1 how they have previously treated the Freelance Jungle Patreon membership expense. As mentioned above, this is influenced by your particular stock and trade as to what expenses you can claim. For example, your accountant may see it as a professional membership, learning experience or something that is available to you under taxable costs. In short, the Patreon membership may be tax deductible, depending on your specific circumstances and it is advised to seek professional counsel to confirm. I can’t advise on what specific tiers relate to your potential to claim.

SUMMATION of Patreon and GST

- Expect a 10% increase to your deduction to cover taxation purposes

- If you are GST registered, you treat it as you do with other GST collection

- It you are not registered for GST, you’ll need to check with your accountant to see if it’s an eligible expense for claims