As much as we wish it wasn’t freelance debt collection strategies are a vital part of this here self-employed life.

Yet one of the biggest issues facing freelancers is our inability to ask for what we’re due. Things like respect, appreciation and basic working rights definitely fall into this category. But the biggest stumbling block we face is getting paid.

We suck beyond measure at valuing ourselves. We’re asked for free work- and we give it. We face a lot of scope creep- and we fail to manage it. We’re chronically under-paid- and we resent it but often don’t push back. And then, once we quote and do the work, we often face late payment.

This makes having workable freelance debt collection strategies a vital part of your skill base as a working freelancer. Here’s where to start

Why is it important?

You only have to spend a week in the Freelance Jungle community group or look up “late payment” in the search to see that there’s a serious need for freelance debt collection strategies. But anecdotal evidence or intersection with the problem is not the only proof we have there is an issue.

In the Freelance Jungle 2019 survey, only 38% of you said you could live off your freelancing. And over 50% of you cited issues with payment.

What the heck, people! We cannot go on living like this.

Anyone working in mental health will suck in their breathe and look uncomfortable when you share those stats.

Is it any wonder? Applied and continued financial strain places people at risk. That risk is related to how we handle prolonged, even low level, stress. Too much stress puts us at risk of acquired mental health conditions. Debt is even linked to increased risk of suicide.

It also places physical stress on the body. This in turn increases our risk of poor health outcomes. Conditions like heart disease, high blood pressure, digestive ailments, insomnia, diabetes, psoriasis and cancer are potential risks. Plus, it can influence our weight and eating disorders. They heighten our risk of addiction through negative coping mechanisms.

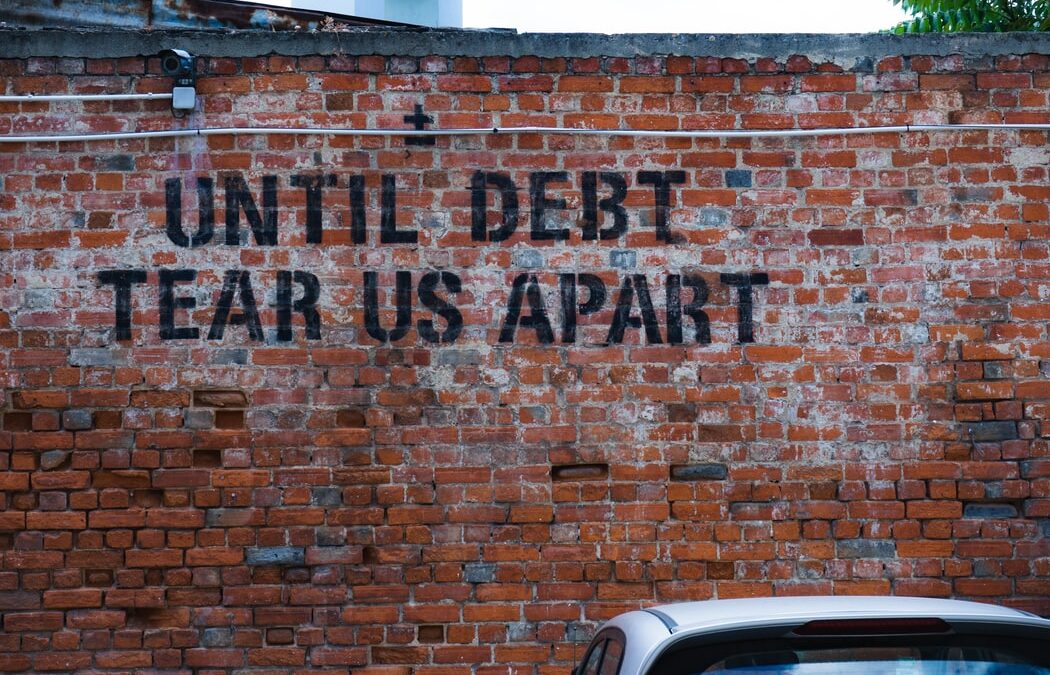

Relationships can become strained by changes in finances and even breakdown. You may experience a kind of strange poverty. One where you are Ok on the ledger but cash poor. Outstanding money that you cannot access to pay bills, keep a roof over your head or put sufficient food on the table. It may even cause you to cross moral boundaries, take risks and potentially even break the law if the strain becomes too much.

Nothing is worth this amount of mental, physical or emotional torture. Please oh please, take your right to be paid for work seriously. Make it your business to have freelance debt collection strategies that you can activate when and if they are needed.

My worst payment horror story

After several months of not being paid my retainer, a former client of mine had to held accountable for not paying me. Nothing else worked other than regular visits to his bar. I sat there, day after day, telling anyone who asked why I was there. He would pay me in $500 lots from the till and I would go away. When his business dissolved in NSW, I was one of only three people in their entire 100+ workforce that was paid. That included the bar staff and those on salaries and wages. Many only received cents in the dollar.

If I hadn’t pursued them relentlessly, I would have been one of the unlucky ones.

I got wise after that. Their sob story is not my problem. After all, only they know if they can afford to pay me- and for how long. And I know my story is more a near miss than an actual horror story. I’ve heard many worse ones.

If a business or a person can’t balance the books to pay things, it’s a reflection on a business that is in a poor financial state. Don’t allow yourself to get caught up in their problems.

Rock the boat, baby!

The most common things I hear from freelancers when you suggest they use freelance debt collection strategies are-

I don’t want them to stop working with me.

They might tell other people I am difficult to deal with.

It’s too stressful having to fight over money.

If I say something, they’ll get mad.

This happens to me all the time.

It’s what happens in freelancing.

They should know I need to get paid and just do it.

You’re making excuses for your clients. These excuses allow your debt to grow and bills to remain unpaid. Common sense is a bullshit concept sitting sidesaddle with equally bullshit common courtesy. The only person who benefits from these excuses are the clients.

We have to change our mind about the relationship between freelancer and client. We’re in service to their needs, but we’re not in servitude. They have no right to play games with your economic situation. We shouldn’t be cutting them slack, living in fear or resigning ourselves to a terribly underpaid fate.

What can you do if the client isn’t listening?

Freelance debt collection strategies do not need to be involved to be effective. They simply need to be planned, activated and consistent.

· Make yourself impossible to ignore. If you only call or email once a month, you are easy to dismiss. You have to stay present and front of mind. You have to prove the pain of dealing with you is worse than paying the bill

· Use the Collectmore App scripts to ask for payment

· Frame your situation with the client in a benefit for them– “If this situation continues, I will need to consult a debt collector. What can you do today to avoid that happening?”

· Give them options – “If you cannot pay the full amount, what can you pay today?” and follow that up with a payment plan

· Consider incentives. Offer them a discount for clearing the debt by the end of the week. I don’t advocate for rewarding bad behaviour. But a debt collector can take between 20-30% of the outstanding amount to extract it. It might be cheaper to offer a discount to the client instead

· Highlight the consequences. One of the most effective way to get a client to pay is to remind them money isn’t their only risk. Reputation is also at risk. If you end up in Small Claims Court and you win, they’ll have to wear that financial judgement on their record for 6 years. And that judgement will often prohibit them from holding contracts with government departments and NFP organisations. As well as some large-scale organisations

· Walk the talk. Follow through with Small Claims Court in obtaining a judgement if that is what it takes. Stay consistent with your chasing if you’ve said you are not going away

· Act. Hire a debt collector to extract the amount owed

But I want to keep the client!

I know it might sound harsh to enforce debt, but here’s the reality check you may need:

Ø Respect comes through standing up (not sitting down). A client that doesn’t respect you now won’t respect you until they see you stand up for yourself. And yes, I know from experience they do mend their ways once you do. It’s happened to me three times. Clients have accepted upfront payment terms and stricter conditions after I have pushed the issue

Ø A messy client costs you more money than you realise. Not only is there no money in your pocket, they are wasting what you sell- which is your time. If you are chasing clients for money, that’s time spent away from work. If you are still working for them and you resent them (which is understandable), it’ll likely slow your work down as it eats away at your motivation.

Ø Your creativity will suffer. Stress is the number one monster within for creative people. Once we’re distracted by late payments, our creativity drops. It’s hard to problem-solve a client’s project if you can’t even solve the problem of getting money in your account. Don’t let it take up that brain space because if time is your King of Hearts, creativity is most definitely the Queen in freelancing

Ø It’s harder to trust once you’ve been screwed over. And once you stop trusting, life as a freelancer becomes really hard. It’s harder to see the good in people. Fighting off the cynicism, remain motivated, and give people the benefit of the doubt is tough. Further protections like training tricky clients to behave and enacting healthy client management becomes stressful. You can even feel less confident about your abilities. And so on if you have had that naïve, wonderful freelance heart of yours smashed open. You have to protect it. And part of that is making sure you stand up when it matters

Ø It feels better once its over. Hindsight is always 20/20. But there is nothing worse than looking back and realising how many hours, days, weeks and months a bad debtor ate from your calendar. The relief you feel has to be immediate to keep up the productivity levels you need to survive

Ø You set the tone for the client relationship. The more you accept late payment as your destiny, the more you accept you are not worth the money or the effort in your client’s eyes. The impact on your confidence overtime cannot be understated. If you don’t stand up for you, who will? And why will take you seriously?

How to develop your own freelance debt collection strategies

· Take the time to review your outstanding invoices

· Note down the last time you contacted them

· What can you do today to improve the chance of being paid?

Make the choice to make financial health as a freelancer a priority. If you need a hand, I suggest getting in touch with Holly Shoebridge for a coaching session for an accountancy-based perspective. Or yours truly for tips on client management and negotiation.

Here’s to better financial outlooks all round!